Free payroll calculator 2020

The entire HR operations run directly on a corporate communication software eg. A computer is a digital electronic machine that can be programmed to carry out sequences of arithmetic or logical operations computation automaticallyModern computers can perform generic sets of operations known as programsThese programs enable computers to perform a wide range of tasks.

Payroll Calculator 2020 Deals 51 Off Www Ingeniovirtual Com

Choose Tax Year and State.

. Youll have to calculate everything by hand keep track of records and file your taxes. We are reliable and established. MyAccount is a single access point to secure online services such as PAYE services including Jobs and Pensions HRI MyEnquiries and more.

For any academic help you need feel free to talk to our team for assistance and you will never regret your decision to work with us. Switch to Oregon hourly calculator. If the return is not.

Payroll Payroll services and support to keep you compliant. Check if you have multiple jobs. Tax Year for Federal W-4 Information.

Flexible hourly monthly or annual pay rates bonus or other earning items. Brighton Hove Albion 2022 payroll table including breakdowns of salaries bonuses incentives weekly wages and more. Manual do-it-yourself payroll is a common choice for many small businesses.

Beyond SBIR and STTRthe two major federal research and development grant programssome federal government agencies also offer specific government grants for small businessesWe trawled through a few databases of federal small business grantsof which the Catalog of Federal Domestic Assistance is the authoritative sourceand pulled the most. Follow the guidelines below and use our free calculator to seamlessly calculate your employee retention rate. 2021 2020 2019.

A computer system is a complete computer that includes the hardware. Access the Vehicle Registration Tax VRT calculator. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free federal paycheck calculator.

This calculator uses the redesigned W-4 created to comply with the elimination of exemptions in the Tax Cuts and Jobs Act TCJA. Running payroll is complicated and making mistakes can get costly. We have worked with thousands of students from all over the world.

Computes federal and state tax withholding for paychecks. An Ad may appear at the bottom of the page from time to time Please for to QA Page for for Support Questions and Feedback on the software. Choose Tax Year and State.

2022 Payroll Table Active Contracts Multi-Year Spending Positional Spending Financial Summary 2023 Free Agents. Auction Calculator New Interface Scores. Nevada has it all.

QuickBooks Payroll Software helps small businesses to run and manage payroll seamlessly and hassle-free. Calculate your Oregon net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Oregon paycheck calculator. An updated look at the Baltimore Orioles 2022 payroll table including base pay bonuses options tax allocations.

2022 Payroll Table Active Contracts Multi-Year Spending Positional Spending Financial Summary 2023 Free Agents. Braves 2022 Payroll An updated look at the Atlanta Braves 2022 payroll table including base pay bonuses options tax allocations. Save 50 for 3 months Do more of what you love with QuickBooks.

You can entrust all your academic work to course help online for original and high quality papers submitted on time. But the process can be time-consuming. Check if you have multiple jobs.

Tax Year for Federal W-4 Information. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Manual payroll might not be the best long-term solution.

2022 Payroll Table Active Contracts Multi-Year Spending Positional Spending Financial Summary 2023 Free Agents. Estimate your tax refund with HR Blocks free income tax calculator. Asanify believes in the principles of AWE Agile.

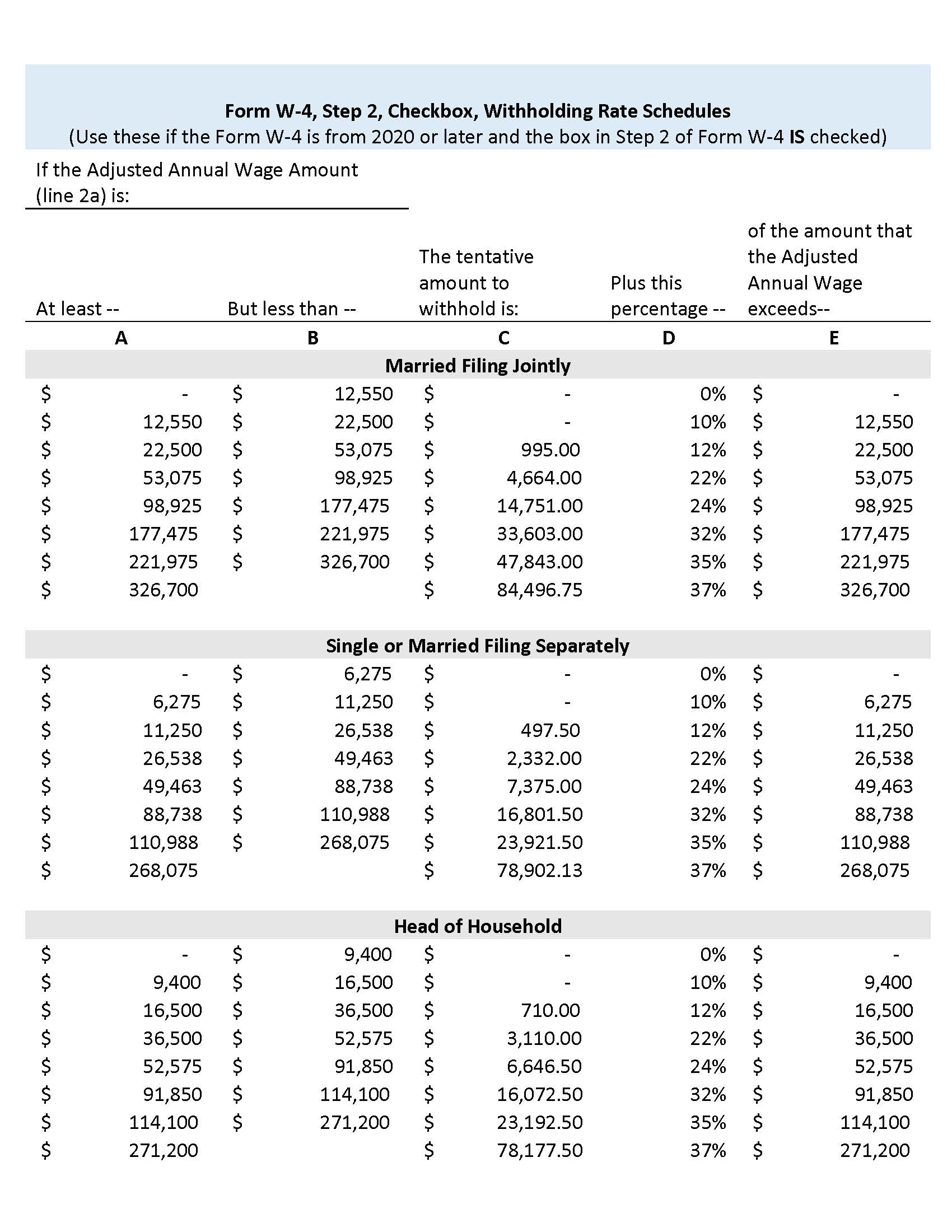

Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T. Use this simplified payroll deductions calculator to help you determine your net paycheck. An updated look at the Colorado Rockies 2022 payroll table including base pay bonuses options tax allocations.

Motivate your employees with a delightful interface. Mileage calculation provided by the Australia Taxation Office - 72 cents per kilometre from 1 July 2020 for the 202021 income year. Determine the number of employees on the first day of the period.

Other Income not from jobs Other Deduction. Lowest price automated accurate tax calculations. We also offer a 2020 version.

Try it save time and be compliant. Sign in or register. Electronic Certificate of Conformity e-CoC for Vehicle Registration Tax VRT Online services.

Filing Status Children under Age 17 qualify for child tax credit Other Dependents. Its never been easier to calculate how much you may get back or owe with our tax estimator tool. Subscribe To Newsletter.

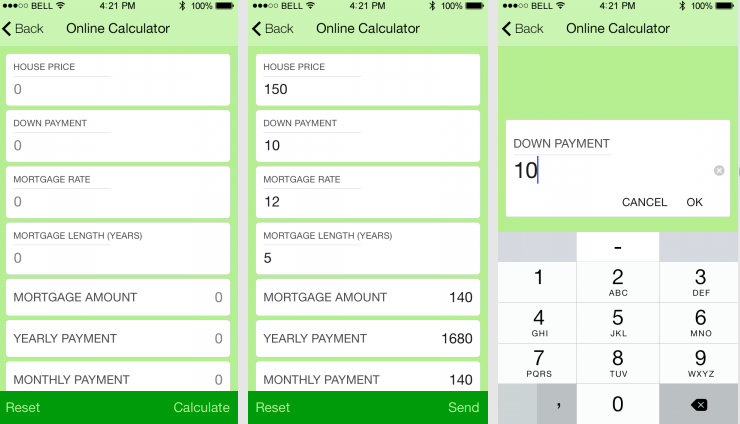

The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. Use our free check stub maker with calculator to generate pay stubs online instantly. Your household income location filing status and number of personal exemptions.

This information should be easy to acquire simply check your payroll to determine the number of individuals in your employment on the given date. The Free Payroll Software is Ad supported. Making Human Resources processes agile is important to reduce waste.

Play-by-play data prior to 2002 was obtained free of charge from and is copyrighted by Retrosheet. Try paystub maker and get first pay stub for free easily in 1-2-3 steps. Filing Status Children under Age 17 qualify for child tax credit Other Dependents.

Other Income not from jobs Other Deduction. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. For employees with a reference date of 30 October 2020 calculate 80 of the average wages payable between 6 April 2020 or if later the date the employment started and the day before they were.

Its got the Biggest Little City in the World. But whether you own the trendiest bar in Tahoe or the hippest coffee shop on The Strip as a small business owner you care about something that Nevada doesnt have. Switch to hourly calculator.

Its got Incline Village. Offer valid for returns filed 512020 - 5312020. Fairness transparency in human resources and payroll management Engage.

March 6 2020 at 314 pm Based on this scenario minimum of 12 for salaries more than RM5000 and 13 for salaries lower than that.

Payroll Calculator 2020 Deals 51 Off Www Ingeniovirtual Com

How To Calculate Taxes On Payroll Sale 51 Off Www Quadrantkindercentra Nl

Payroll Calculator 2020 Deals 51 Off Www Ingeniovirtual Com

Payroll Calculator 2020 Deals 51 Off Www Ingeniovirtual Com

Payroll Calculator 2020 Deals 51 Off Www Ingeniovirtual Com

Hourly Paycheck Calculator Step By Step With Examples

Free Online Paycheck Calculator Calculate Take Home Pay 2022

How To Calculate Taxes On Payroll Sale 51 Off Www Quadrantkindercentra Nl

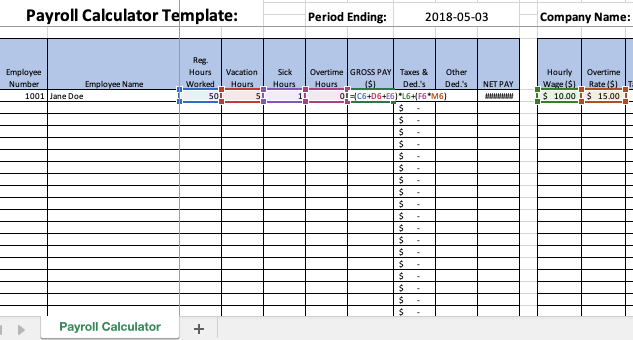

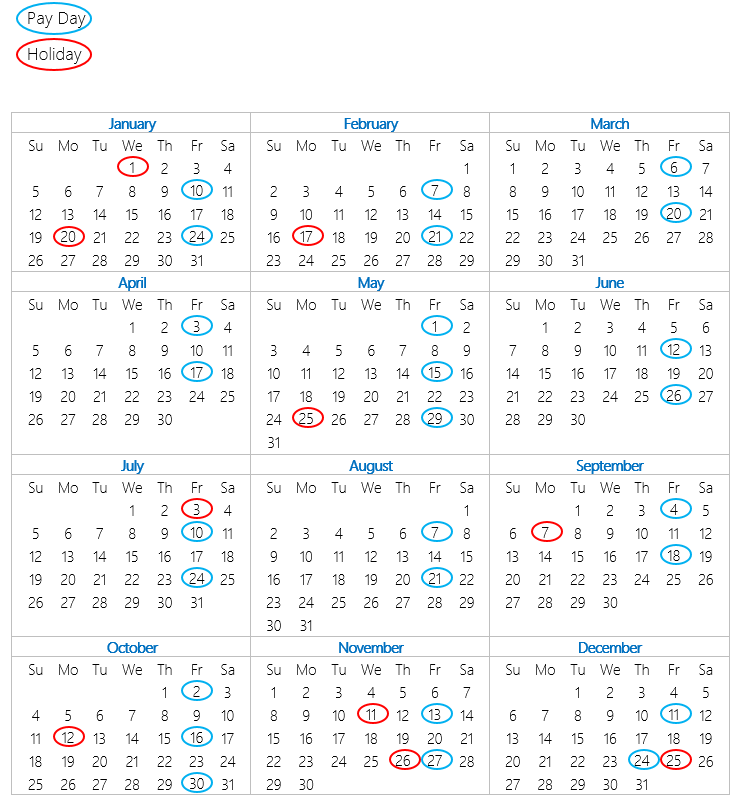

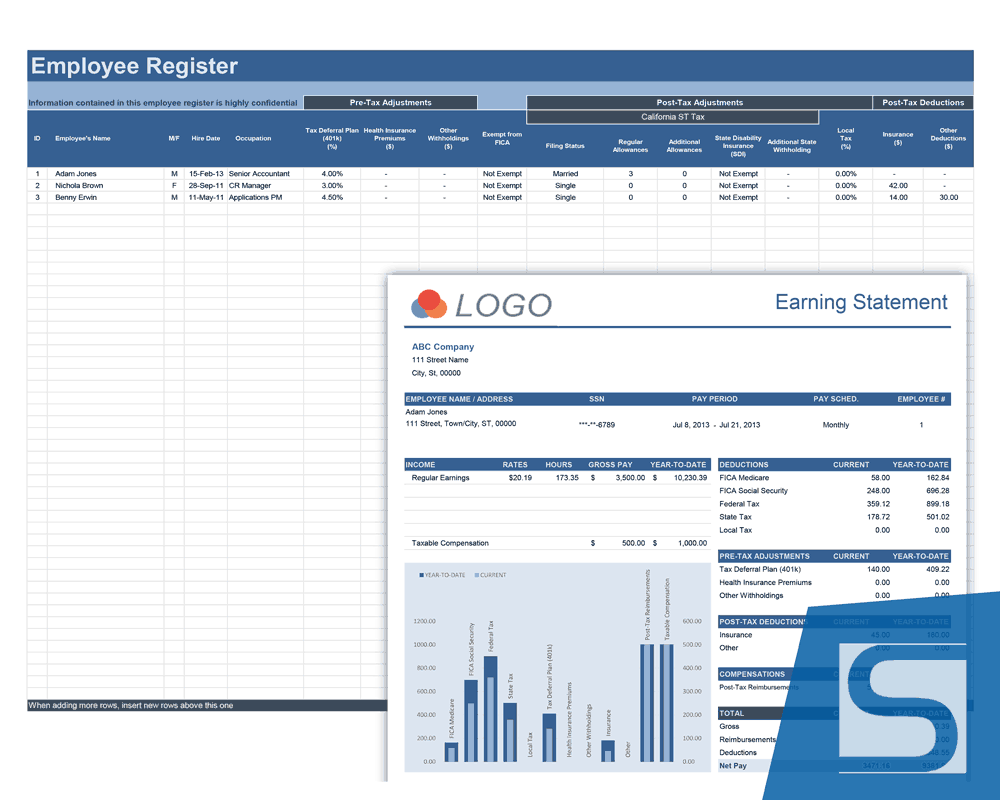

Payroll Calculator Free Employee Payroll Template For Excel

Adp Paycheck Calculator Outlet 56 Off Www Quadrantkindercentra Nl

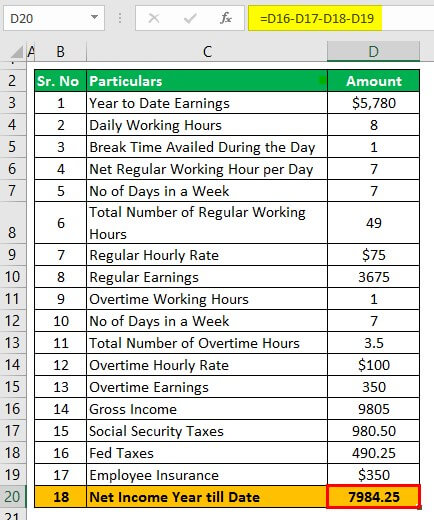

In Hand Salary Calculator Hotsell 58 Off Www Quadrantkindercentra Nl

Payroll Calculator 2020 Deals 51 Off Www Ingeniovirtual Com

Payroll Calculator Free Employee Payroll Template For Excel

How To Calculate Taxes On Payroll Sale 51 Off Www Quadrantkindercentra Nl

How To Calculate Taxes On Payroll Sale 51 Off Www Quadrantkindercentra Nl

How To Calculate Taxes On Payroll Sale 51 Off Www Quadrantkindercentra Nl

Payroll Calculator Free Employee Payroll Template For Excel